Are you aware of the top dental insurance options available in 2025 that can significantly reduce your dental care costs?

Choosing the right dental coverage is crucial for maintaining good oral health without breaking the bank. With numerous plans available, understanding the best dental insurance plans 2025 has to offer can be overwhelming.

This article aims to guide you through the process of selecting the most suitable dental insurance plan for your needs, highlighting key features and benefits of the top dental insurance options.

Key Takeaways

- Overview of the best dental insurance plans for 2025

- Key features to look for in a dental insurance plan

- Top dental insurance options for different needs

- How to choose the right dental coverage for you

- Benefits of having the right dental insurance plan

Understanding Dental Insurance Coverage

Understanding your dental insurance coverage is crucial for making informed decisions about your oral health. Dental insurance plans vary widely, but most provide coverage for essential dental care.

What Dental Insurance Typically Covers

Most comprehensive dental insurance plans cover routine cleanings, exams, and basic procedures like fillings and extractions. Some plans may also include coverage for more complex procedures such as crowns, bridges, and root canals, although this can vary.

Preventive care is a key component of dental insurance, emphasizing regular check-ups to prevent more serious issues. This typically includes routine cleanings and exams, which are fundamental to maintaining good oral health.

Common Limitations and Exclusions

While dental insurance covers a range of services, there are common limitations and exclusions. Many plans have waiting periods before covering major procedures, and some may exclude certain conditions or treatments, such as cosmetic dentistry.

Understanding these limitations is crucial for choosing a plan that meets your needs. Look for plans that offer affordable dental coverage without sacrificing essential benefits.

How to Evaluate Dental Insurance Plans

Evaluating dental insurance plans can be a daunting task, but with the right guidance, you can make an informed decision. When comparing plans, it’s essential to consider several key factors to ensure you choose the best coverage for your needs.

Key Factors to Consider When Comparing Plans

To evaluate dental insurance plans effectively, consider the following factors: coverage options, network providers, and cost-sharing structures. Leading dental insurance providers offer a range of plans with varying levels of coverage, so it’s crucial to assess your dental health needs before making a decision.

Understanding Premiums, Deductibles, and Annual Maximums

Premiums, deductibles, and annual maximums are critical components of dental insurance plans. Premiums are the monthly payments you make to maintain coverage, while deductibles are the out-of-pocket expenses you incur before the insurance kicks in. Annual maximums refer to the maximum amount the insurance provider will pay for dental care within a calendar year.

| Plan Feature | Description | Example |

|---|---|---|

| Premium | Monthly payment for coverage | $50/month |

| Deductible | Out-of-pocket expense before insurance kicks in | $100/year |

| Annual Maximum | Maximum amount insurance will pay for dental care | $1,500/year |

Waiting Periods and Coverage Percentages

Waiting periods refer to the time you must wait before certain dental services are covered. Coverage percentages indicate the percentage of dental expenses covered by the insurance provider. Understanding these factors is vital to compare dental insurance rates effectively.

Network Considerations: PPO vs. HMO

Dental insurance plans often have different network structures, such as PPO (Preferred Provider Organization) or HMO (Health Maintenance Organization). PPO plans offer more flexibility in choosing dentists, while HMO plans typically require you to select a primary dentist from a predefined network.

Best Dental Insurance Plans for 2025

As we dive into 2025, it’s essential to identify the best dental insurance plans that cater to various needs and preferences. With so many options available, choosing the right plan can be overwhelming. Here, we’ll explore the top dental insurance providers, highlighting their strengths and benefits.

Delta Dental – Best Overall Coverage

Delta Dental stands out for its comprehensive coverage and extensive network of dentists. With a wide range of plans, Delta Dental offers excellent coverage for preventive care, basic procedures, and major treatments. According to a recent survey, Delta Dental has been rated highly by its customers for its coverage and network.

Cigna Dental – Best for Affordability

Cigna Dental is known for its affordable premiums and flexible plan options. Cigna offers competitive pricing without compromising on the quality of coverage. As noted by a dental insurance expert, “Cigna Dental provides great value for the price.”

Guardian Dental – Best for Families

Guardian Dental offers plans that are particularly beneficial for families. Their coverage includes extensive pediatric care and family-oriented benefits. Guardian Dental is praised for its family-friendly approach to dental insurance.

Humana Dental – Best for Seniors

Humana Dental excels in providing coverage tailored to seniors’ needs. Their plans often include coverage for dentures, implants, and other senior-specific dental needs. Humana Dental is recognized for its senior-focused benefits.

MetLife Dental – Best for Comprehensive Coverage

MetLife Dental is renowned for its comprehensive coverage options. MetLife offers plans that cover a wide range of dental services, from routine cleanings to complex procedures. As stated by a MetLife representative, “Our goal is to provide comprehensive coverage that meets the diverse needs of our customers.”

Aetna Dental – Best for Network Size

Aetna Dental boasts an extensive network of dental providers, making it easier for members to find in-network dentists. Aetna’s large network is one of its standout features, offering convenience and flexibility to its members.

In conclusion, the best dental insurance plans for 2025 offer a mix of comprehensive coverage, affordability, and specialized benefits. By considering these top providers, individuals and families can make informed decisions about their dental insurance needs.

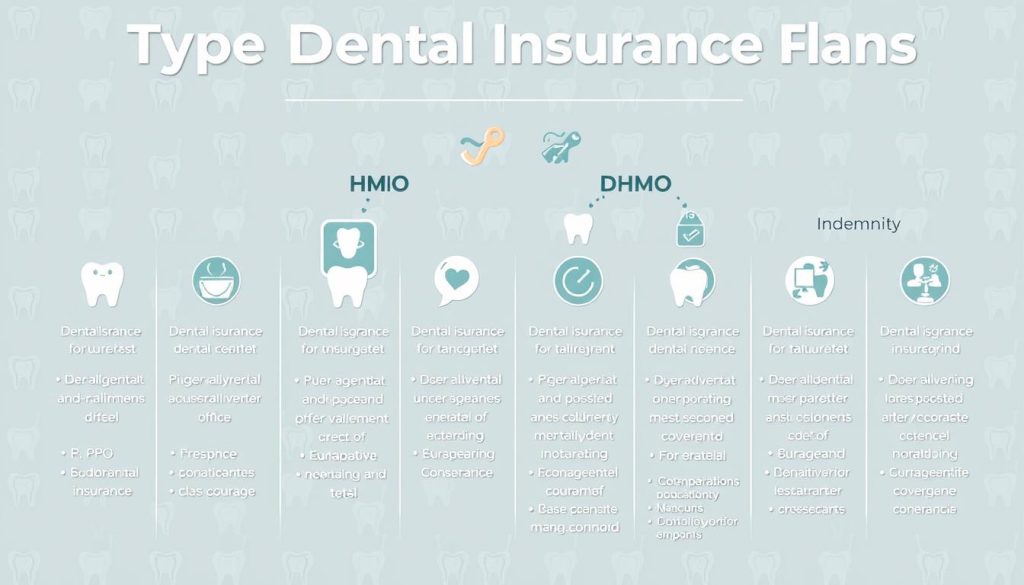

Types of Dental Insurance Plans Explained

Navigating the world of dental insurance can be complex, but understanding the different types of plans available is crucial for making an informed decision. Dental insurance plans vary significantly in terms of coverage, cost, and flexibility, making it essential to explore the characteristics of each.

Dental PPO Plans

Dental PPO (Preferred Provider Organization) plans offer a network of dentists from which to choose, with discounted rates for services within the network. They provide flexibility in choosing a dentist, both in and out of network, although out-of-network care typically costs more.

Dental HMO Plans

Dental HMO (Health Maintenance Organization) plans require selecting a primary dentist from the network, who coordinates all dental care. These plans are often more affordable but offer less flexibility than PPO plans.

Dental Discount Plans

Dental discount plans are not insurance but offer discounted dental services for an annual fee. They can be a cost-effective option for those without insurance or needing additional coverage.

Indemnity Dental Plans

Indemnity dental plans, also known as fee-for-service plans, reimburse patients for dental expenses, allowing them to choose any dentist. These plans often come with higher premiums and deductibles.

| Plan Type | Flexibility | Cost |

|---|---|---|

| Dental PPO | High | Moderate |

| Dental HMO | Low | Low |

| Dental Discount | Variable | Low (annual fee) |

| Indemnity | High | High |

Step-by-Step Guide to Choosing the Right Dental Insurance

With so many dental insurance options available, it’s essential to have a step-by-step guide to help you choose the right one. Selecting the best dental insurance plan involves several considerations, from assessing your dental health needs to understanding enrollment periods.

Step 1: Assess Your Dental Health Needs

Start by evaluating your current dental health and anticipating future needs. Consider factors like the frequency of dental visits, required treatments, and any ongoing dental issues. This assessment will help you determine the level of coverage you need.

Step 2: Determine Your Budget

Decide how much you can afford to spend on dental insurance each month. Consider not just the premiums, but also deductibles, copays, and any out-of-pocket expenses. Compare different plans to find one that fits your budget while providing adequate coverage.

Step 3: Check Provider Networks

Ensure that your preferred dentists are part of the insurance network. Check if the plan includes a wide network of providers or if it has limitations. A plan with a broad network can offer more flexibility.

Step 4: Compare Coverage Options

Look at what each plan covers, including preventive care, basic procedures, and major treatments. Some plans may offer additional benefits like orthodontic coverage or cosmetic procedures.

Step 5: Understand Enrollment Periods

Be aware of the enrollment periods for dental insurance plans. Missing the enrollment period could mean waiting until the next cycle to sign up, potentially leaving you uninsured.

By following these steps, you can make an informed decision and choose a dental insurance plan that meets your needs and budget. Consider dental insurance benefits and dental insurance quotes to make the best choice.

Maximizing Your Dental Insurance Benefits

Choosing the right dental insurance plan can significantly impact your oral health and financial well-being. By understanding the various coverage options and selecting a plan that suits your needs, you can enjoy substantial dental insurance savings. Whether you’re looking for dental insurance for families or individual coverage, the key is to carefully evaluate your options.

Consider factors such as premiums, deductibles, and annual maximums when comparing plans. Additionally, understanding the differences between PPO, HMO, and other types of dental insurance plans can help you make an informed decision. By doing so, you can ensure that you and your family receive the necessary dental care without incurring significant out-of-pocket expenses.

Ultimately, the right dental insurance plan can provide peace of mind and help you maintain good oral health. Take the time to review your options, and don’t hesitate to seek professional advice if needed. With the right plan, you can enjoy a healthier smile and maximize your dental insurance savings.

Leave a Reply